In the world of data driven decision making, financial analytics plays a vital role for BBA (Bachelor of Business Administration) students, equipping them with essential skills and knowledge for a wide range of career opportunities in the finance and business sectors. Here is a breakdown of its significance:

1. Enhanced Decision-Making:

- Financial analytics empowers BBA students to move beyond intuition and make data-driven decisions. By analyzing financial statements, market trends, and economic indicators, they can gain valuable insights into a company’s performance, profitability, and risk exposure.

- This ability to interpret financial data and draw meaningful conclusions is crucial for effective management and strategic planning.

2. Risk Management Proficiency:

- Understanding financial analytics enables BBA students to identify potential financial risks early on. By analyzing historical data and forecasting future trends, they can help businesses develop strategies to mitigate these risks and protect their financial health.

- This skill is highly valued in today’s volatile economic environment.

3. Improved Budgeting and Forecasting:

- Financial analytics provides the tools and techniques necessary for accurate budgeting and forecasting. BBA students learn how to analyze past financial performance, identify key drivers, and build financial models to predict future outcomes.

- This allows organizations to allocate resources efficiently, plan for growth, and maintain financial stability.

- Budgeting is the financial direction of where management wants to take the company.

- It helps quantify the expectation of revenues that a business wants to achieve for a future period.

- Financial forecasting tells whether the company is headed in the right direction, estimating the amount of revenue and income that will be achieved in the future.

- Budgeting creates a baseline to compare actual results to determine how the results vary from the expected performance.

- Financial forecasting is used to determine how companies should allocate their budgets for a future period.

Cost Control and Efficiency:

- By applying financial analytics, BBA students at JIMSVASNTKUNJII can analyze spending patterns, identify areas of inefficiency and recommend cost-saving measures.

- This contributes directly to improving a company’s bottom line and overall operational efficiency.

5. Profitability Analysis:

- Financial analytics helps in evaluating the profitability of different business segments, products or services. BBA students learn to analyze revenue streams and cost structures to identify the most profitable areas and advise on resource allocation accordingly.

- This focus on profitability is essential for sustainable business growth.

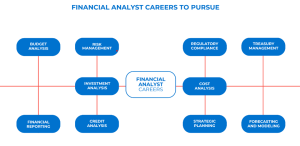

6. Career Opportunities:

- A strong foundation in financial analytics opens up diverse career paths for BBA graduates, including roles such as:

- Financial Analyst: Analyzing financial data, providing investment recommendations and creating financial models.

- Business Analyst: Using data to identify business opportunities and recommend solutions.

- Investment Banker: Assisting companies with raising capital through the issuance of stocks and bonds, and advising on mergers and acquisitions.

- Market Research Analyst: Analyzing market trends and providing insights for strategic decision-making.

- Financial Consultant: Providing financial advice to individuals and organizations.

- Risk Analyst: Identifying and assessing financial risks.

- Credit Analyst: Evaluating the creditworthiness of borrowers.

- Fund Manager: Managing investment portfolios.

7. Essential Skills Development:

- Studying financial analytics in final year equips BBA students with a valuable set of skills:

- Analytical and Problem-Solving Skills: The ability to interpret complex data and draw logical conclusions.

- Quantitative Skills: Strong mathematical and statistical abilities.

- Financial Modeling: Creating and using financial models for forecasting and analysis.

- Data Analysis and Interpretation: Extracting meaningful insights from large datasets.

- Communication and Presentation Skills: Effectively conveying financial information to various stakeholders.

- Software Proficiency: Familiarity with tools like Excel, Statistical Software (e.g., R, Python, SAS), and data visualization tools (e.g., Tableau, Power BI).

- Financial Literacy: A strong understanding of accounting principles, financial statements, and market dynamics.

- Financial Planning & Investment : Learn to analyze key investment options like FD, SIP, and government loans, while mastering financial metrics, tax compliance (GST, EPF, deductions), and debt management. Gain the skills to assess risks, mitigate fraud, and design effective strategies for managing cash flow, profitability, and insurance coverage.

Financial Analyst Career Path ….Further Education and Certifications:

To accelerate your career growth and earning potential after a BBA, consider pursuing:

- MBA in Finance: A Master of Business Administration (MBA) with a specialization in Finance is a common next step that can open doors to more advanced roles.

- Chartered Financial Analyst (CFA): This globally recognized certification is highly valued in the investment management industry and enhances your credibility and expertise.

- Certified Public Accountant (CPA): While more accounting-focused, a CPA can be beneficial, especially if you are interested in roles involving financial reporting and auditing.

- Financial Risk Manager (FRM): If you are interested in risk management, this certification is highly relevant.

- Other specialized certifications: Depending on your area of interest (e.g., data science, valuation), additional certifications can be beneficial.

Key Skills to Focus On:

- Strong Analytical and Quantitative Skills: Your BBA in Finance should have provided a foundation, but continuously hone your data analysis and problem-solving abilities.

- Financial Modeling: Develop proficiency in building and using financial models in tools like Excel.

- Understanding of Financial Statements: Possess a solid grasp of balance sheets, income statements, and cash flow statements.

- Communication Skills: Learn to present complex financial information clearly and concisely, both verbally and in writing.

- Software Proficiency: Master Excel and become familiar with financial analysis tools and databases.

- Attention to Detail: Accuracy is crucial in financial analysis.

Career Progression:

After gaining experience in an entry-level role, typically within 2-4 years, you can progress to more senior positions:

- Financial Analyst (Mid-Level): You’ll take on more complex tasks, build sophisticated financial models, conduct in-depth analysis, and start contributing to strategic decision-making.

- Senior Financial Analyst: With more experience (5+ years), you’ll lead projects, mentor junior analysts, interact more with stakeholders, and play a significant role in financial planning and forecasting.

- Finance Manager: You’ll oversee financial operations, manage teams, and be responsible for financial reporting and analysis for a department or business unit.

- Director of Finance/VP of Finance: In these senior leadership roles, you’ll be involved in setting the overall financial strategy for the organization.

- Chief Financial Officer (CFO): This is the highest level in the finance career path, where you’ll be responsible for the entire financial health and strategy of the company.

Key Takeaways for a BBA Graduate:

- A BBA in Finance provides a solid foundation for a career as a Financial Analyst.

- Start with entry-level roles to gain practical experience.

- Focus on developing strong analytical, financial modeling, and communication skills.

- Consider pursuing further education or professional certifications to enhance your career prospects and earning potential.

- Network with professionals in the finance industry to learn about opportunities and trends.

By strategically building your skills and experience after your BBA, you can carve out a successful and rewarding career path as a Financial Analyst.

In conclusion, financial analytics is not just a subject for BBA students; it’s a crucial toolkit that empowers them with the analytical prowess and financial acumen demanded by today’s business world, leading to enhanced decision-making capabilities and a wider array of promising career opportunities. Moreover, Career as a Financial Analyst offers a well-defined path for growth with increasing responsibilities and attractive salary progression. Continuous learning, skill development, and strategic career moves are key to maximizing potential in this field.

Dr. Nilima Thakur

Asst. Professor

BBA Department

JIMSVKII

Very nice blog.

Best BCA college in Delhi ncr.

Very good explanation of financial analytics and such type of blog will surely help bba students.

Career after class 12 and there after BBA – A Good Future

Career after class 12 and there after BBA – A Good Future

Interesting blog.

Best BCA college without Maths in Delhi NCR.

Financial literacy is beautifully explained. Very nice

Very informative

Knowledgeable blog

In this blog,financial concepts are explained properly.

Very informative thanks for sharing